Introduction When it comes to managing finances, understanding your tax liabilities is crucial. This is an essential tool for individuals and businesses alike. This article will provide a comprehensive guide to understanding and utilizing this calculator effectively. Understanding Tax Arrears Before delving into the specifics of the relief calculator, it’s essential to grasp the concept of tax arrears. Tax arrears refer to the amount of tax that remains unpaid after the due date. Failure to pay tax arrears can result in penalties and interest charges, making it imperative to address…

Read MoreTag: Download Auto Calculate Income Tax Form 10E for the F.Y.2023-24

Exemptions and Deductions under the Old Tax Regime-A Guide for the Financial Year 2023-24 with Automatic Income Tax Preparation Software in Excel All in One for the F.Y.2023-24

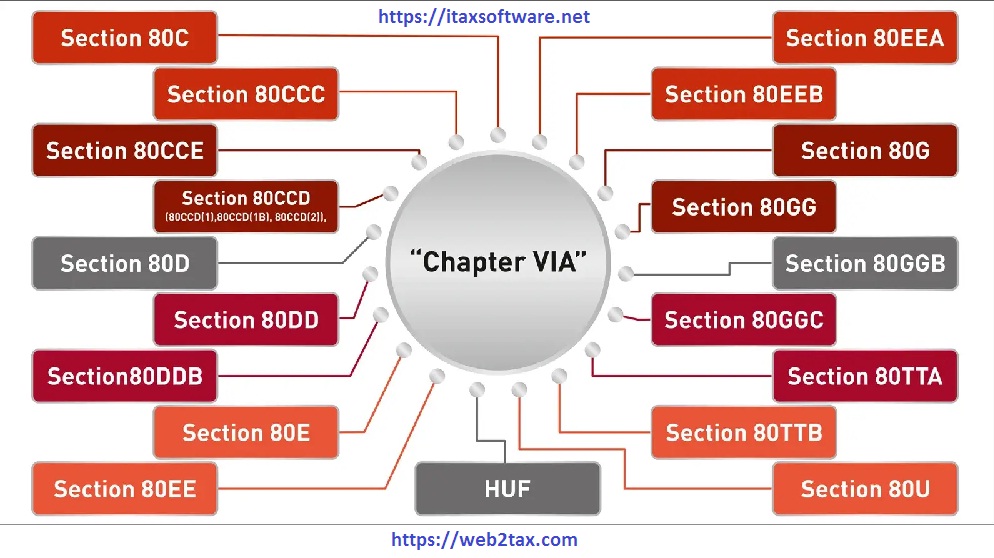

Introduction Exemptions and Deductions under the Old Tax Regime-A Guide for the Financial Year 2023-24. In the complex realm of taxation, Therefore, understanding exemptions and deductions is crucial for every taxpayer. The financial year 2023-24 brings with it a set of rules that dictate how individuals can reduce their taxable income. In other words, In this article, we will delve into the specifics of Section 80C and Section 10 of the Income Tax Act, unravelling the opportunities they offer. Exemptions and Deductions under the Old Tax Regime-A Guide for the Financial…

Read MoreMaximize Your Refund – Using Excel for Form 10E Income Tax Calculations F.Y.2023-24 in Excel

In today’s world, where every penny counts, maximizing your income tax refund is crucial. Therefore, If you’re looking for a way to optimize your refund and make the tax filing process smoother, Excel can be your best friend. However, In this article, we’ll guide you through the steps of using Excel for Form 10E income tax calculations, ensuring you get the most out of your tax return. Introduction However, Setting Up Excel For instance, Calculating Income Tax Excel Functions Above all, Filling Out Form 10E In Conclusion After that, Now, let’s dive…

Read MoreHow to Calculate Income Tax Arrears Relief Calculation U/s 89(1)-With Auto Calculate Relief Calculator U/s 89(1) and Form 10E for FY2023-24

Introduction In the realm of taxation, understanding the intricacies of income tax arrears and relief calculations under Section 89(1) is crucial for individuals seeking to manage their financial liabilities efficiently. Therefore, This article will guide you through the process of calculating income tax arrears relief under Section 89(1). Whether you’re a salaried employee or a pensioner, this information can help you navigate the complexities of tax planning. Section 89(1): An Overview In other words, Section 89(1) of the Income Tax Act, of 1961, provides relief to taxpayers who receive salary or…

Read MoreHow to Calculate Income Tax Arrears Relief Calculation U/s 89(1)-With Auto Calculate Relief Calculator U/s 89(1) and Form 10E for FY2023-24

Introduction In the realm of taxation, understanding the intricacies of income tax arrears and relief calculations under Section 89(1) is crucial for individuals seeking to manage their financial liabilities efficiently. Therefore, This article will guide you through the process of calculating income tax arrears relief under Section 89(1). Whether you’re a salaried employee or a pensioner, this information can help you navigate the complexities of tax planning. Section 89(1): An Overview In other words, Section 89(1) of the Income Tax Act, of 1961, provides relief to taxpayers who receive salary or…

Read MoreUnderstanding Income Tax Section 80C-A Comprehensive Guide With Income Tax Auto Calculate Relief Form 10E for FY2023-24

Introduction Income tax planning is a vital aspect of personal finance. One of the most significant sections in the Indian Income Tax Act is Section 80C. In this article, we will delve into the details of Section 80C, breaking down its various aspects and offering insights into how you can maximize its benefits to optimize your tax liability. Before we dive into the nitty-gritty of Section 80C, let’s understand its relevance and significance in the realm of tax-saving and financial planning. What is Income Tax Section 80C? Section 80C of…

Read MoreMaximize Deductions with Tax Strategies and Auto Calculate Income Tax All in One for the Government and Non-Government Employees for F.Y.2023-24

In today’s ever-changing financial landscape, optimizing your tax deductions is more crucial than ever before. With the right tax strategies, individuals and businesses can minimize their tax liabilities and maximize their financial resources. Therefore, This article will guide you through effective tax strategies that will help you keep more of your hard-earned money in your pocket. Table of Contents 1. Introduction: The Importance of Tax Deductions In other words, Tax deductions are a powerful tool to legally reduce your taxable income, thereby lowering the amount of taxes you owe to the…

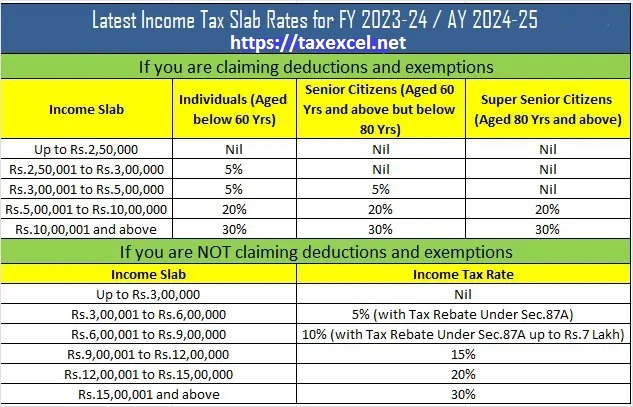

Read MoreIs Sec 87A Tax Rebate Rs.50,000/- Available in both Tax Regimes? With Auto Calculate Income Tax Preparation Software All in One for the Government and Non-Government Employees for the F.Y.2023-24 as per Budget 2023

Is Sec 87A Tax Rebate Rs.50,000/- Available in both Tax Regimes? With Auto Calculate Income Tax Preparation Software All in One in Excel for the Government & Non-Government Employees for the F.Y.2023-24 as per Budget 2023 In India’s tax world, knowing the rules is crucial. Section 87A is a hot topic—it offers a tax rebate of Rs. 50,000 to individual taxpayers. But does it work in both old and new tax systems? Let’s dive in and find out. We’ll also explore a handy income tax tool for government and non-government…

Read MoreHow to Pay Less Income Tax for the Year 2023-24-A Simple Guide With Auto Calculate Income Tax Arrears Relief Calculator U/s 89(1) with form 10E for the F.Y.2023-24

Let’s talk about how you can pay less income tax for the years 2023-24. Therefore, It’s important to know this stuff, and I promise it won’t be too complicated. Getting Tax Deductions In other words, First, think about tax deductions. These are like discounts on your tax bill. You can use them to pay less tax. Here are some ideas: 1. Home Loan Interest However, If you have a home loan, you can pay less tax. The government says you can take away the interest you pay on your loan from…

Read MoreAuto Calculate Income Tax Arrears Relief Calculator U/s 89(1) with Form 10E for F.Y.2023-24 in Excel

Income tax can be confusing, but it’s crucial to manage it well. One essential tool is the Income Tax Arrears Relief Calculator in Excel for the financial year 2023-24. In this guide, we’ll explain what it is and how it can help you. Understanding Income Tax Arrears Income tax arrears mean unpaid or underpaid tax from previous years. If you’ve paid too much tax or missed deductions in the past, Section 89(1) of the Income Tax Act can help you get relief. What is Section 89(1)? This section in the…

Read More