Tax season can be a daunting time for many of us. Whether you’re a seasoned professional or just starting out in your career, understanding your tax obligations is crucial. Fortunately, with the advancements in technology, calculating your tax burden has become more accessible than ever. In this article, Therefore, we’ll explore how you can effortlessly calculate your tax liability for the Financial Year 2024-25 and Assessment Year 2025-26 using an automatic income tax calculator, all conveniently packed into an Excel spreadsheet.

Table of Contents

| Sr# | Headings |

| 1. | Understanding Financial Year and Assessment Year |

| 2. | What Is an Income Tax Calculator? |

| 3. | Benefits of Using an Excel-Based Tax Calculator |

| 4. | How to Use the Income Tax Calculator in Excel? |

| 5. | Key Components of the Income Tax Calculator |

| 6. | Filling in Your Income Details |

| 7. | Deductions and Exemptions |

| 8. | Calculating Tax Liability |

| 9. | Understanding Tax Slabs |

| 10. | Finalizing Your Tax Return |

| 11. | Tips for Maximizing Tax Savings |

| 12. | Common Mistakes to Avoid |

| 13. | Frequently Asked Questions (FAQs) |

| 14. | Conclusion |

However, Understanding The Financial Year and Assessment Year

Before diving into tax calculations, let’s clarify the terminology. The Financial Year (F.Y.) refers to the period during which you earn income, while the Assessment Year (A.Y.) is the year following the F.Y. in which you file your tax return based on the income earned in the preceding F.Y.

What Is an Income Tax Calculator?

Above all, An income tax calculator is a tool designed to assist taxpayers in estimating their tax liability based on their income, deductions, and exemptions. In other words, It simplifies the often complex process of tax calculation and enables individuals to plan their finances more effectively.

Benefits of Using an Excel-Based Tax Calculator

After that, Excel-based tax calculators offer several advantages. In addition, They provide a user-friendly interface, allow for customization, and enable quick calculations and scenario analysis. Moreover, Excel’s versatility allows users to integrate additional functionalities and create personalized tax planning tools.

You may also Download Automatic Income Tax Form 16 Part B in Excel for the Financial Year 2023-24[This Excel Utility can Prepare at a time 50 Employees Form 16 Part B]

In addition, How to Use the Income Tax Calculator in Excel?

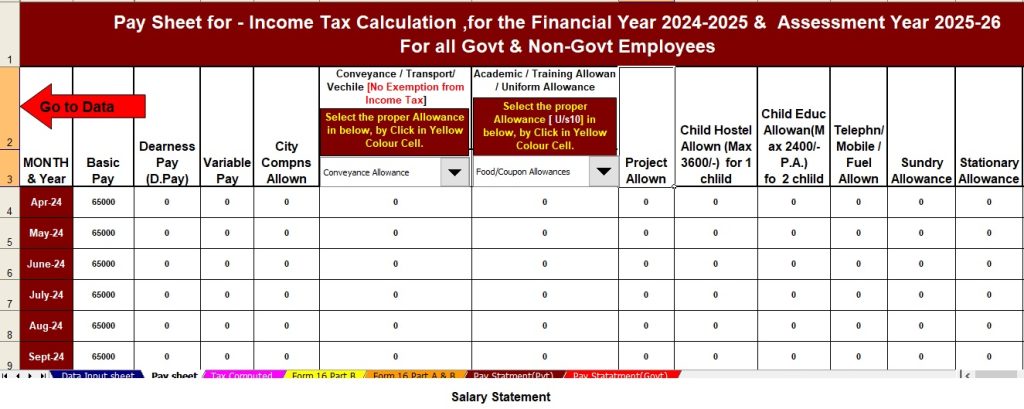

Using the income tax calculator in Excel is straightforward. Similarly, Simply input your income details, deductions, and exemptions into the designated cells. The calculator will then automatically compute your tax liability based on the prevailing tax rates and slabs.

Above all, Key Components of the Income Tax Calculator

The income tax calculator typically consists of various sections, including:

Similarly, Filling in Your Income Details

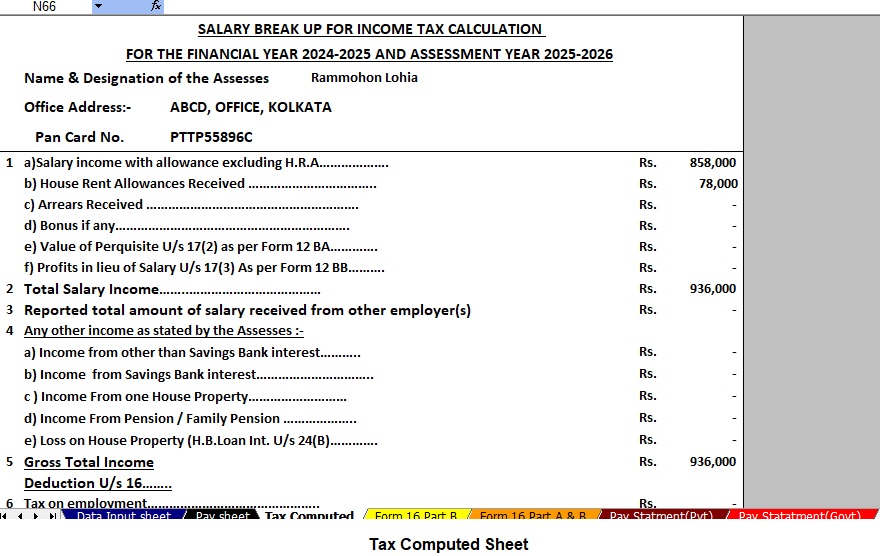

Here, you’ll enter details such as salary, income from other sources, and capital gains, if any.

However, Deductions and Exemptions

This section allows you to claim deductions under various provisions of the Income Tax Act, such as Section 80C, 80D, and 80G.

Therefore, Calculating Tax Liability

However, The calculator computes your tax liability based on the applicable tax rates and slabs for the given financial year.

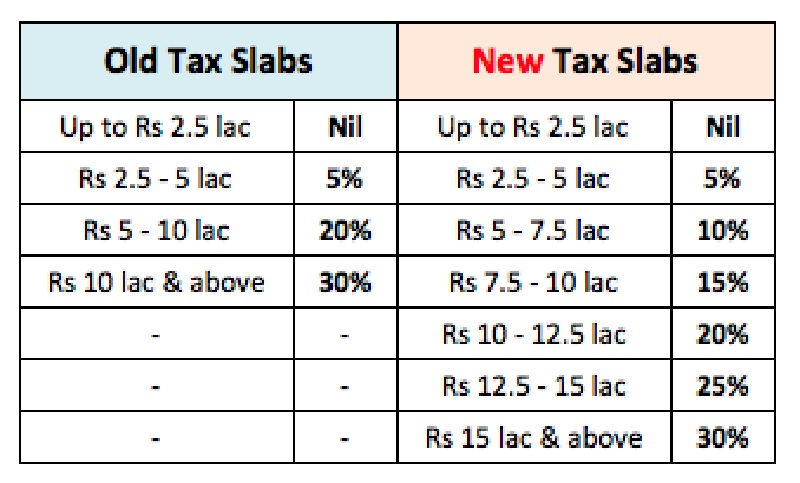

After that, Understanding Tax Slabs

Similarly, Tax slabs represent different income brackets, each taxed at a progressively higher rate. Understanding these slabs is essential for accurate tax calculation.

In addition, Finalizing Your Tax Return

Once you’ve filled in all the necessary details, the calculator generates a summary of your tax liability, which you can use to file your tax return.

Above all, Tips for Maximizing Tax Savings

To minimize your tax burden, consider utilizing tax-saving investment options such as ELSS, PPF, and NPS. Additionally, stay informed about available deductions and exemptions to optimize your tax savings.

For instance, Common Mistakes to Avoid

Avoid common pitfalls such as incorrect data entry, overlooking eligible deductions, and ignoring tax planning opportunities. After that, Regularly review your finances and seek professional advice if needed.

However, Frequently Asked Questions (FAQs)

- Can I use the income tax calculator for any financial year? Yes, you can use the calculator for any financial year, but ensure you’re using the updated tax rates and slabs for the respective year.

- Is the income tax calculator compatible with all versions of Excel? Most income tax calculators are designed to work with various versions of Excel, but it’s recommended to use the latest version for optimal performance.

- Can I use the calculator for business income calculations? The calculator is primarily designed for salaried individuals but can be customized for business income calculations with appropriate modifications.

- Is the income tax calculator accurate? While the calculator provides a reliable estimate, the accuracy ultimately depends on the correctness of the input data and the prevailing tax laws.

- Can the calculator help me plan for future tax liabilities? Yes, by simulating different scenarios and adjusting income and deductions, you can proactively plan for future tax liabilities.

In conclusion,

Navigating the complexities of income tax calculation can be overwhelming, but with the right tools and knowledge, it becomes more manageable. Therefore, By leveraging an Excel-based income tax calculator, you can streamline the process, optimize your tax planning, and ensure compliance with tax regulations. In other words, Start empowering yourself today to take control of your finances and minimize your tax burden. Happy calculating!

Download the all-in-one Auto Calculate Income Tax Preparation Software in Excel, designed for all salaried individuals for the Financial Year 2024-25 and Assessment Year 2025-26 in accordance with Budget 2024.

Here’s what this Excel utility offers:

- It swiftly prepares and computes your income tax based on the New Section 115 BAC, catering to both the New and Old Tax Regimes.

- For instance, You have the flexibility to select your preferred tax regime – New or Old – with ease.

- For instance, Tailored with a unique Salary Structure catering to the needs of all salaried individuals.

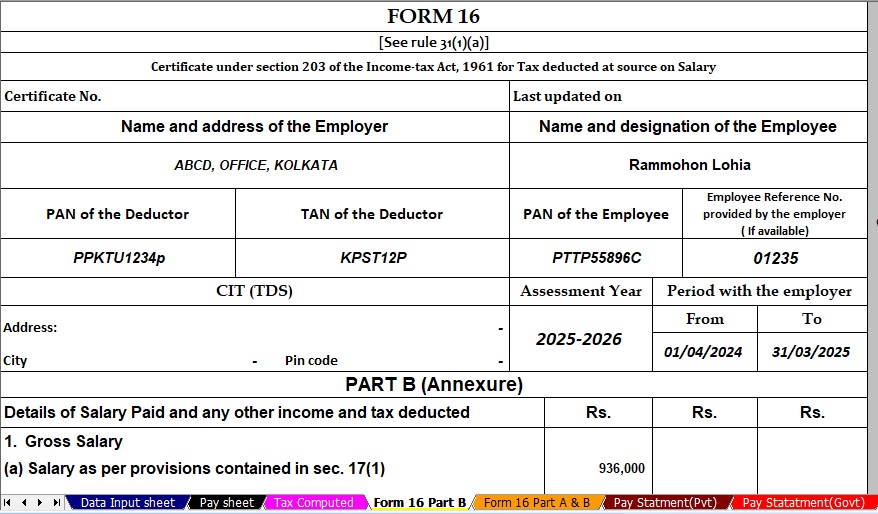

- Automatically generates Income Tax Revised Form 16 Part A&B for the Financial Year 2024-25.

- Seamlessly generates Income Tax Revised Form 16 Part B for the Financial Year 2024-25.