Auto Calculate Income Tax Preparation Software in Excel for the Non-Govt (Private or PSU) Employees for the F.Y.2023-24 and A.Y.2024-25 | Section 80C of the Income Tax Act of India is a provision that allows individuals to claim deductions on investments and expenses. It is one of the most popular tax-saving options for individuals in India. Section 80C allows taxpayers to reduce their taxable income by investing in eligible instruments or making certain payments.

Therefore,

The maximum deduction available under section 80C is 1.5 Lakh per financial year. In other words, This means that individuals can reduce their taxable income by up to Rs.1.5 Lakh using the provisions of this section. However, it is important to note that this limit is the total income under section 80C as well as other sections like 80CCC and 80CCD.

You may also like- Automated Income Tax Form 16 Part A&B for the F.Y.2022-23 and A.Y.2023-24 which can prepare at a time 50 Employees Form 16 Part A&B in Excel

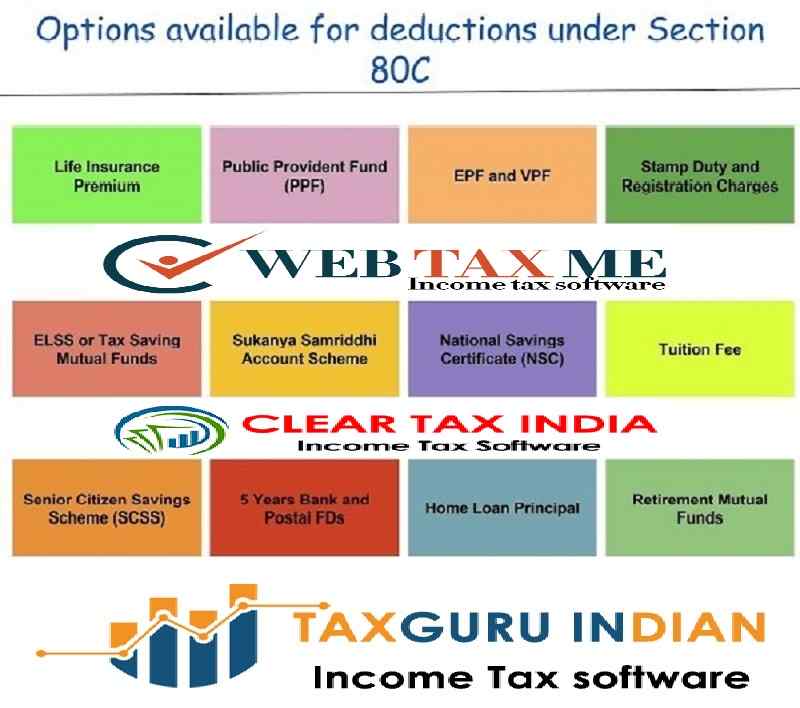

However, there are several investments and expenses that are eligible for deduction under section 80C. Let’s take a look at some options:

For instance,

1. Life Insurance Premiums: Premiums paid on life insurance policies for you, your spouse, or your children are eligible for deduction under section 80C. However, the premium should not exceed 10% of the sum insured.

2. Employees’ Provident Fund (EPF): Contributions to EPF by salaried individuals are exempt under section 80C. The contribution made by the employee is deducted from his salary and the employer also contributes on behalf of the employee to EPF.

You may also like- Automated Income Tax Form 16 Part B for the F.Y.2022-23 and A.Y.2023-24 which can prepare at a time 50 Employees Form 16 Part B in Excel

3. Above all, Public Provident Fund (PPF): Eligible for exemption under section 80C. PPF is a long-term investment option with a maturity of 15 years. Interest earned and the amount matured is also tax-free.

4. In addition, National Savings Certificates (NSCs): Investments in NSCs are eligible for issuance under section 80C. NSCs are fixed-income instruments issued by the Post Office for 5 or 10 years. Interest earned on USCs is taxable.

5. After that, 5 years bank tenure: Scheduled bank term deposits with a tenure of 5 years or more are eligible for deduction under section 80C.

6. Similarly, Fixed Income Deposits: Some banks offer Fixed Income Deposits which have a tenure of 5 years and are eligible for withdrawal under Section 80C. Interest earned is taxable.

7. Equity Linked Savings Scheme (ELSS): ELSS is a type of mutual fund that invests in stocks. ELSS investments are eligible for withdrawal under section 80C subject to a 3-year lock-in period.

8. Home Loan Principal Payment: The principal component of Eligible Monthly Installment (EMI) paid for a home loan is eligible for deduction under Section 80C. However, this exemption is claimed only if the property is not sold within 5 years.

9. However, Early childhood education fees: Education fees for up to two children are eligible for deduction under section 80C. This includes fees for schools, colleges, universities, and other educational institutions.

In other words, It should be noted that certain investments under section 80C have a lock-in period. This means that the money cannot be withdrawn before a certain time. For example, fixed income deposits usually have a lock-in period of 5 years, while PPF has a minimum lock-in period of 15 years.

In conclusion,

In addition, the total limit for exemption under section 80C is Rs 1.5 lakh. This limit includes the income required for investment and expenditure under sections 80C and 80CCC (for pension plans

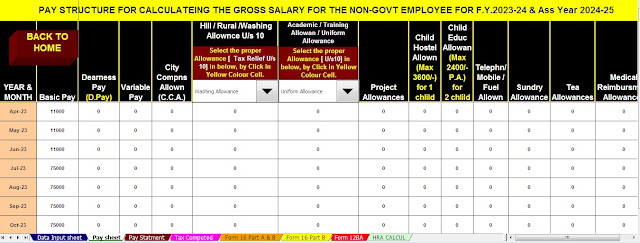

Download Excel All in One Automated Income Tax Preparation Software for Non-Government (Private or PSU) Employees for Financial Year 2023-24and Assessment Year 2024-25 U/s 115BAC

Therefore, the Features of this Excel utility:-

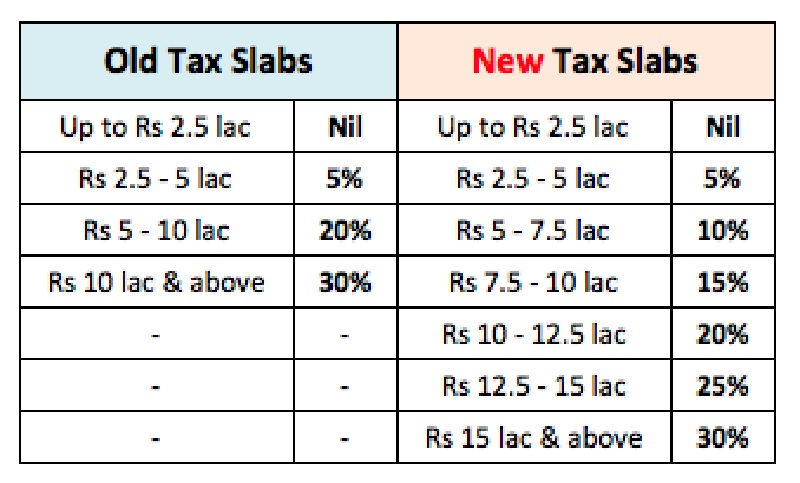

1) This Excel utility perfectly prepares your income tax according to your U/s 115BAC option.

2) This Excel utility has a completely revamped Income Tax section as per Budget 2023

3) Computerized Income Tax Form 12 BA

4) Automatic computation Income Tax Exemption rented house U/s 10(13A).

5) Individual salary structure according to government and private group salary model

6) Individual Pay Sheet

7) Individual tax datasheet

8) Automatic Income Tax Form 16 Part A&B revised for the financial year 2023-24

9) Automatic Income Tax Form 16 Part B revised for the financial year 2023-24